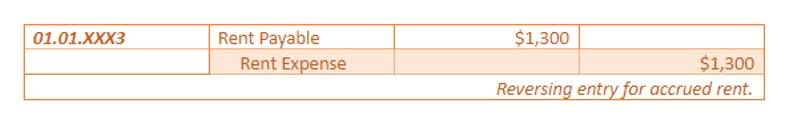

As a result, Oak will deduct the real estate taxes as rent on its tax return for the earlier year. This is the year in which Oak’s liability under the lease becomes fixed. If you lease business property, you can deduct as additional rent any taxes you have to pay to or for the lessor.

Is 70 the new 50?

A new survey from TD Ameritrade found that 73 percent of women said 70 is the new 50, while 59 percent of men said the same. The results come from an online survey that was conducted in July.

Allocate the replacement loan to the same uses to which the repaid loan was allocated. Make this allocation only to the extent you use the proceeds of the new loan to repay any part of the original loan.

Business Bad Debts

If you are the lessor, your income from bonuses and advanced royalties received is subject to an allowance for depletion, as explained in the next two paragraphs. A lessor’s gross income from the property that qualifies for percentage depletion is usually the total of the royalties received from the lease. Regulated natural gas qualifies for a percentage depletion rate of 22%. Regulated natural gas is domestic natural gas produced and sold by the producer before July 1, 1976, and is regulated by the Federal Power Commission. The price for regulated gas cannot be adjusted to reflect any increase in the seller’s tax liability because of the repeal of percentage depletion for gas. For purposes of percentage depletion, gross income from the property is the amount you receive from the sale of the oil or gas in the immediate vicinity of the well. You must obtain consent from the IRS to revoke your election.

- You can’t deduct expenses in advance, even if you pay them in advance.

- You can deduct the rest of the rent payment only over the period to which it applies.

- This credit is partially refundable — if deducting this credit brings your tax balance to zero, 40% of the remaining amount of this credit (up to $1,000) may be given back to you as a tax refund.

- Most sole proprietors, partnerships, and S-corps – and some estates and trusts – qualify for this, but some business services are excluded.

- In-home warranty is available only on select customizable HP desktop PCs.

Any unused portion of the qualified expenses may not be carried over to another taxable year. A credit may be allowed for substantial expenditures incurred in a 24-month period to rehabilitate a certified heritage structure located in Maryland. The credit is available for owner-occupied residential property, as well as income-producing property. If the property is owned jointly by more than one individual such as a husband and wife, each individual owner is entitled to the credit based on their percentage of ownership. Individual members of a pass-through entity are not eligible for this credit. Unclaimed Property Holders required to file by October 31, 2022 please see guidanceon new regulations.

No matter what kind of business you’re in, you definitely want to protect it. And the best way to do that is to getthe right kinds of insurancein place. The cost for many of the insurance premiums you’ll need for your business—like liability insurance, fire and flood insurance or a business owner’s policy—are deductible. Medical insurance for your employees is also deductible under certain circumstances as well. Many small-business owners and their employees spend a lot of time in airports and traveling around the country to do business. But all those airline tickets and hotels can get pricey!

Legal and Accounting Services

Filing this form postpones any determination that your activity is not carried on for profit until 5 years have passed since you started the activity. Generally, you can deduct the full amount of a business expense if it meets the criteria of ordinary and necessary and it is not a capital expense. To qualify to claim expenses for the business use of your home, you must meet both of the following tests. The uniform capitalization rules do not apply to the amount. There are many different kinds of business assets, for example, land, buildings, machinery, furniture, trucks, patents, and franchise rights.

These rules also apply to the deduction of development costs by corporations. The costs of obtaining a patent, including attorneys’ fees paid or incurred in making and perfecting a patent application, are research and experimental costs. However, costs paid or incurred to obtain another’s patent are not research and experimental costs. Even though you paid the premiums for 2021, 2022, and 2023 when you signed the contract, you can only deduct the premium for 2021 on your 2021 tax return.

Employee Wages Deduction

While personal moving expenses are deductible, you can still deduct moving expenses if you relocate your business. You can fully deduct any expenses related to moving such as packing and transport. If you rent an office or building that you use solely for operating your business, you can deduct rent. The stipulation is that, according to the IRS, if you “have or will receive equity in or title to the property,” you cannot write off the rent as a deduction.

Keep reading for a relatively comprehensive list of the various categories of tax deductions that are available to you as a business owner. The rules may vary slightly depending on if you are a sole proprietor, S Corp, LLC, partnership, or the owner of a C Corporation. Some of these expenses are relatively obvious as business expenses. Others are more likely spending that you would have done anyway but, potentially, could be eligible for a tax deduction. I also don’t know many business owners who never use a cell phone for business activities. Many people wonder about the benefit of home offices from a tax standpoint.

These expenditures aren’t deductible for tax purposes, whether or not the owners of the shipyard are subsequently prosecuted. It applies to expenses incurred at a business convention or reception, business meeting, or business luncheon at a club.

IRS Small Business Audits: 9 Red Flags That May Put Your Business at Risk

For those who are too busy to do this, hire a bookkeeper, which can be a lifesaver come tax time, or worse, if you are ever audited. Might I remind you that the costs of bookkeeping software, a tax preparer, and a bookkeeper are all tax-deductible. In this post, we’ll outline the common small business tax deductions and business write offs for 2022, itemized with a list of deductible business expenses. Depending on the amount and the variety of your expenses, you may decide to useaccounting software.

Learn about the best practices on taking the home office deduction. A necessary business expense must be considered useful and relevant to your industry. Social memberships dues – are not deductible but dues for professional business memberships are deductible.

This chapter covers business expenses that may not have been explained to you, as a business owner, in previous chapters of this publication. In general, entertainment expenses are no longer deductible. If a debt becomes totally worthless in the current tax year, you can deduct the entire amount minus any amount deducted in an earlier tax year when the debt was only partly worthless. If you receive property in partial settlement of a debt, reduce the debt by the property’s FMV, which becomes the property’s basis. You can deduct the remaining debt as a bad debt if and when it becomes worthless. The debt arose from the sale of goods or services in the ordinary course of your trade or business. If you loan money to a client, supplier, employee, or distributor for a business reason and you’re unable to collect the loan after attempting to do so, you have a business bad debt.

How much will I be taxed if I withdraw cash?

TDS will be deducted at 2% on cash withdrawals of more than ₹ 20 lakh and 5% for withdrawals exceeding ₹ 1 crore if the person withdrawing the cash has not filed ITR for any of the preceding three AYs.

The limits for Section 179 deductions and bonus depreciation have increased. That means you and your tax professional can do some tax planning. But you’ll need the help of someone who is familiar with the details of depreciation; it’s tricky, believe me. The Dirty Dozen is compiled annually by the IRS and lists a variety of common scams taxpayers may encounter any time during the year. Many of these con games peak during filing season as people prepare their tax returns or hire someone to do so. Aggressive and threatening phone calls by criminals impersonating IRS agents remain near the top of the annual Dirty Dozen list of tax scams for the 2021 filing season. The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process.

Failure of the qualified business entity to report the amount claimed disqualifies the entity from claiming any unclaimed amount of the project tax credit. A 501 tax-exempt organization may estimate the amount of the tax credit for qualifying employees for the tax year. The total amount of the estimated credit should be divided evenly over the number of periods for filing withholding returns . For example, if quarterly returns are required, then the total estimated credit should be divided by four. Each payment to the Comptroller would be reduced by the pro rata amount of the credit.

Tax Due Dates for September 2016

For a winery or a vineyard to claim a tax credit, an individual or corporation on behalf of the winery or vineyard must apply to and be certified by the Maryland Department of Commerce . The winery or vineyard must submit an application to DOC by September 15th following the tax year in which the qualified capital expenses were incurred. Businesses that invest in research and development in Maryland may be entitled to an income tax credit. Tax Pros Warn Small Business Owners Not To Try To Deduct These 9 Expenses The total credits for all businesses may not exceed $9 million a year. The credit may be taken against corporate income tax, personal income tax, state and local taxes withheld (for certain tax-exempt organizations only), insurance premiums tax or public service company franchise tax. The amount to be recaptured is the amount originally claimed as a tax credit multiplied by the percentage reduction in the number of qualified employees.

Eligibility for interest deductions varies based on your business’s structure, so be sure to consult an accountant to see if you qualify for the mortgage interest business deduction. There is no limit on the number of deductions you can take. Consult with an accountant or tax professional to confidently take all of the write-offs that your business qualifies for.

There may be limits on how much of the loss you can deduct. If you recover part of an expense in the same tax year in which you would have claimed a deduction, reduce your current year expense by the amount of the recovery. If you have a recovery in a later year, include the recovered amount in income in that year.

Keep records of the date and place of each meal, as well as who attended and what the business relationship is. Business tax audit support does not include reimbursement of any taxes, penalties, or interest imposed by tax authorities. We have in-person bookkeeping services and online bookkeeping options to keep you on course. https://quickbooks-payroll.org/ Let us give you a hand to ensure your books are accurate and up-to-date. If your small business makes and resells products, you should value your inventory at the beginning and end of each tax year to figure out the cost of goods sold. An ordinary business expense must qualify as something commonly accepted in your industry.

Once you’ve identified and categorized your startup costs, create a visual one-page report that you can add to your business plan, which will help guide you as you seek various types of funding. Here’s anexample of a startup cost reportfrom the Small Business Administration.

While this tax reform is still being fully realized, your accountant is your best friend. If you have any questions or concerns about which deductions you are eligible for and which small business expenses you can write off, talk to your accountant or another tax professional for the most accurate business advice.

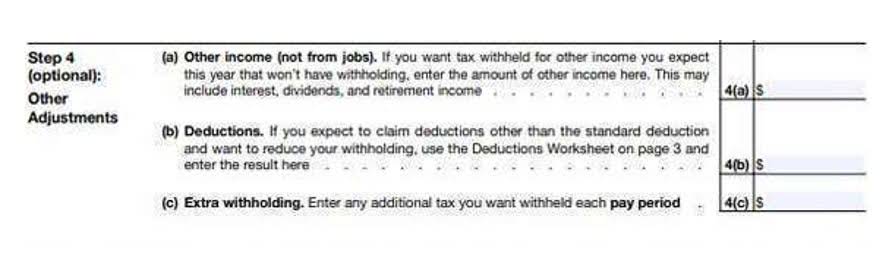

You can still claim certain expenses as itemized deductions on Schedule A .. If your deductions for an investment or business activity are more than the income it brings in, you have a loss.

Pass-through entities , filing Maryland Form 510 with eligible project costs and eligible start-up costs must follow the additional instructions following Part P-IV Summary of Form 500CR. The business must purchase Maryland-mined coal during the tax year. To take the credit against the income tax, an application must be submitted to the State Department of Assessments and Taxation .

Interest expense

Amounts paid in settlement of actual or possible liability for a fine or penalty, whether civil or criminal. Any officer or employee of the White House Office of the Executive Office of the President and the two most senior level officers of each of the other agencies in the Executive Office. Your work clearly requires the expense for you to satisfactorily perform that work.

The IRS will compare your compensation to the standard for a similar position in a similar industry, and it’s a big red flag if you’re significantly outside the acceptable range. As you may expect, mistakes on your tax filings are going to attract IRS attention. However, you may not realize that you’re making a mistake when you do the math. Donations are a great way to support important causes and help people in need. Unfortunately, the IRS adopts a more skeptical view of small businesses giving to charity. If your business suddenly increases the amount of money donated in a year, the IRS may want to make sure that these donations aren’t an attempt to abuse the tax code.